Retirement

Where will your retirement money come from? If you’re like most people, qualified-retirement plans, Social Security, personal savings and investments are expected to play a role. Once you have estimated the amount of money you may need for retirement, a sound approach involves taking a close look at your potential retirement-income sources.

Risk Tolerance: What’s Your Style?

Learn about what risk tolerance really means in this helpful and insightful video.

Have A Question About This Topic?

Timing Your Retirement

This short video illustrates the importance of understanding sequence of returns risk.

Retirement Questions That Have Nothing to Do With Money

Things to consider before retirement.

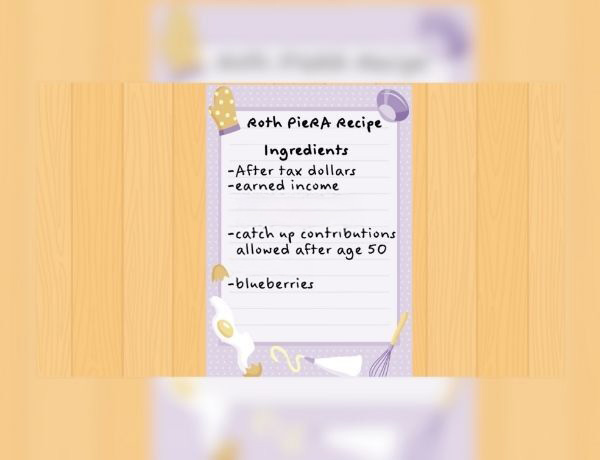

How to Bake a Pie-R-A

Roth IRAs are tax-advantaged differently from traditional IRAs. Do you know how?

Why annuities are in demand

Demand for annuities is surging as consumers look for ways to lock in guaranteed retirement income.

Women on the Rise

Explore the growing influence women wield over the economy with this handy infographic.

Retirement Questions That Have Nothing to Do With Money

Things to consider before retirement.

3 important insurance considerations for retirees

In retirement planning, evaluating your insurance policies is a good policy.

Choose Your Own Retirement Adventure

Retirement is one of the greatest adventures you’ll have. Which retirement adventure will you choose?

How to get your finances ready for retirement

To live the retirement you want you need to plan ahead. Taking these steps may help.

View all articles

A Look at Systematic Withdrawals

This calculator may help you estimate how long funds may last given regular withdrawals.

Roth 401(k) vs. Traditional 401(k)

This calculator compares employee contributions to a Roth 401(k) and a traditional 401(k).

Inflation & Retirement

Estimate how much income may be needed at retirement to maintain your standard of living.

Saving for Retirement

This calculator can help you estimate how much you may need to save for retirement.

View all calculators

Risk Tolerance: What’s Your Style?

Learn about what risk tolerance really means in this helpful and insightful video.

Leaving Your Lasting Legacy

Want to do more with your wealth? You might want to consider creating a charitable foundation.

What You Need to Know About Social Security

Every so often, you'll hear about Social Security benefits running out. But is there truth to the fears, or is it all hype?

Retirement Accounts When You Change Your Job

This video discusses issues related to your retirement accounts when you move on from your job.

Retirement Redefined

Around the country, attitudes about retirement are shifting.

Working With A Financial Professional

A financial professional is an invaluable resource to help you untangle the complexities of whatever life throws at you.

View all videos

-

Articles

-

Calculators

-

Videos